Table of Contents:-

- Techniques of Cost Control

- importance of cost control

- objectives of cost control

- cost of control meaning

- features of Cost Control

Techniques of Cost Control

Techniques of cost control are essential for businesses to maintain financial stability and achieve long-term success. By implementing techniques such as budgeting, optimizing procurement processes, efficient energy management, standard costing, effective labour management, and leveraging technology, organizations can effectively manage costs and improve their overall financial performance.

1) Budgetary Control

It involves the following steps:

i) Establishment of budgets relating to the responsibilities of executives to the requirements of a policy.

ii) Comparison of actual values with the budgeted value continuously.

iii) Ascertainment of variances along with their causes.

iv) Devising and taking suitable corrective measures.

v) Budgets may be prepared for various activities like Production, Marketing, Capital Expenditure Cash, etc.

2) Standard Costing

It involves the following steps:

i) Techniques of evolution and fixation of standards for the elements of cost.

ii) Comparison of actual costs with standard costs.

iii) Ascertainment of variances along with their causes and points of incidence.

iv) Devising and taking suitable corrective measures.

v) Evaluation of standards of different elements of cost, if necessary.

It is observed from the foregoing that standard costing is basically concerned with the cost aspects of a business and so it is intensive, while budgetary control is concerned with the operation of the business as a whole and hence it is extensive. Further, budgetary control is a prerequisite for the successful operation of the standard costing system in the organization. Thus, both techniques are necessary for cost control purposes.

Cost control is the function of keeping costs within prescribed limits. It is based on the principle of predetermination of costs and achieving these cost levels so that inefficiencies and wastages may be reduced. Budgetary Control and Standard Costing are the two most used techniques of cost control.

The other techniques of cost control are the following:

1) Ratio analysis.

2) Intra-firm and inter-firm comparisons.

3) Material Control: Control on purchase, handling and investment in materials.

4) Labour Control: Control Labour costs including Labour time, productivity and remuneration.

5) Overhead Control: Control production, administrative selling and distribution overheads.

6) Control of capital expenditure.

7) Control Ratios.

8) Efficient reporting.

Cost Control meaning

Over some time, cost control has become much more important than mere cost ascertainment. The bigger the size of a business, the greater the importance of cost control.

The Chartered Institute of Management Accountants, London defines cost control as “the regulation by executive action of the cost of operating an undertaking, particularly where such action is guided by cost accounting”.

Cost control thus involves:

1) Regulation, i.e., significantly influencing the cost of operating the undertaking;

2) The regulation is not automatic but due to conscious effort by the executive;

3) The area of cost control is brought to the notice of the executive;

4) The strategic points of executive interference are pre-determined and the responsibility is fixed on individual executives; and

5) Cost control operates as an essential component of the system of cost accounting and is achieved by comparing actual performance with the pre-determined level of achievement. Cost control is exercised by setting targets, budgets, norms or standards and ascertaining deviations from these for initiating corrective action.

Features of Cost Control

The Features of cost control are as follows:

1) Cost Accounting: Cost accounting is feasible only when an organization has an effective cost accounting system to provide relevant information. Costs should be categorized into controllable and non-controllable. The organization is divided into responsibility centres. Every executive is made responsible for the performance of the centre directly under his control.

2) Cost Planning: Cost control aims at achieving the cost targets. So, an organization should have a proper planning or budgeting system. The targets should be set after taking into consideration all relevant factors The targets need to be feasible and capable of being achieved.

3) Cost Reporting: A proper management reporting system is necessary for perfect monitoring. It must be built in the organization to have a continuous basis of information about the actual and predetermined con of different products or services to the concerning levels of management.

4) Corrective Action: On observing the variances, the management must identify the causes of variances and take appropriate remedial measures.

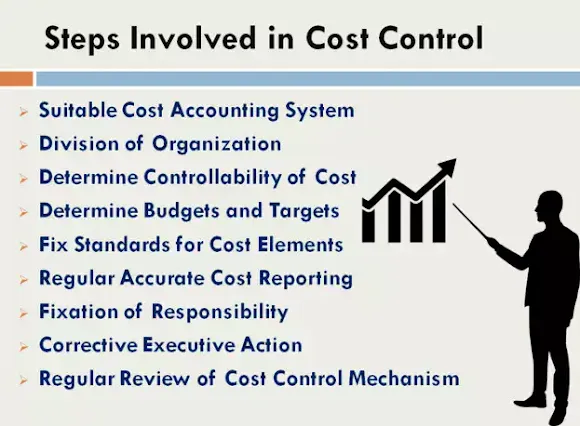

Steps Involved in Cost Control

The steps involved in cost control are:

1) Suitable Cost Accounting System

Cost control requires that adequate and correct cost data is generated for actual cost and should be the cost of each activity or production. The cost accounting system should be appropriate, efficient and cost-effective because of the nature and size of the organization. It should supply reliable and timely information for each segment and sub-segment of the organization.

2) Division of Organization

The organization should be divided into various segments called responsibility centres. The head of each responsibility centre should be held accountable for the performance of the segment directly under him.

3) Determine the Controllability of Cost

Cost should be classified into controllable and non-controllable. For each executive, it should be ascertained as to who can influence which cost and to what extent.

4) Determine Budgets and Targets

For each responsibility centre, realistic budgets and targets should be pre-determined after due consultation with the executive responsible for implementing the budgets. A regular comparison should be made between actual and budgeted performance to ascertain deviations and causes for such deviations.

5) Fix Standards for Cost Elements

Standard costing is an effective tool for cost control. Variances should be ascertained periodically after comparing the actual cost and the pre-determined standard cost. The reasons for deviation should be objectively analyzed for corrective action. Standard costs should be scientifically determined and regularly reviewed and updated.

6) Regular Accurate Cost Reporting

Reports relating to deviations from budgets and variances from standards should be accurate and comprehensive. These should be prepared without delay and submitted to the appropriate authority for timely action. Many of these reports may have pre-specified periodicity while others may be of an ad hoc nature depending upon special occurrences influencing costs.

7) Fixation of Responsibility

The head of a responsibility centre should be held accountable for costs incurred in the segment under his control. All deviations should be reported and analyzed segmentwise.

8) Corrective Executive Action

After thorough analysis and investigation into deviations, necessary corrective action should be taken by senior executives as well as segmental heads so that the incurrence of wasteful expenditure is avoided in future.

9) Regular Review of Cost Control Mechanism

Various control systems, such as budgets, standards, targets, form and content of reports, segmentation in the organization, etc., should be continuously reviewed and modified in light of experience gained and changes in circumstances so that the control mechanism continues to function efficiently and effectively.

Importance of Cost Control

The importance of cost control is mainly as follows:

1) Achieving the expected return on capital employed by maximizing or optimizing profit.

2) Increase in productivity of the available resources.

3) Reasonable price for the customers.

4) Continued employment and job opportunities for the workers.

5) Economic use of limited resources of production.

6) Increased creditworthiness, and

7) Prosperity and economic stability of the industry.